As with all securities, trading options entails the risk of the option's value changing over time. However, unlike traditional securities, the return from holding an option varies non-linearly with the value of the underlier and other factors. Therefore, the risks associated with holding options are more complicated to understand and predict.

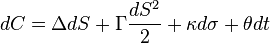

In general, the change in the value of an option can be derived from Ito's lemma as:

where the Greeks Δ, Γ, κ and θ are the standard hedge parameters calculated from an option valuation model, such as Black-Scholes, and dS, dσ and dt are unit changes in the underlier price, the underlier volatility and time, respectively.

Thus, at any point in time, one can estimate the risk inherent in holding an option by calculating its hedge parameters and then estimating the expected change in the model inputs, dS, dσ and dt, provided the changes in these values are small. This technique can be used effectively to understand and manage the risks associated with standard options. For instance, by offsetting a holding in an option with the quantity − Δ of shares in the underlier, a trader can form a delta neutral portfolio that is hedged from loss for small changes in the underlier price. The corresponding price sensitivity formula for this portfolio Πis:

Комментариев нет:

Отправить комментарий